The Advantages of Solar Power Purchase Agreements (PPA)

There exist multiple financing instruments for solar photovoltaic systems. Among the most successful and widely adopted method for financing the clean energy revolution through solar and wind in the United States is the Power Purchase Agreement or most commonly abbreviated and known in the industry as the PPA.

An important and attractive feature of the PPA is that it is a no-money down solution for the end-user. It’s as simple as paying electricity on a separate bill at a lower rate with all the bells and whistles included on-site. This gives businesses and non-profits the ability to market themselves as going green and to save money on one of their key operating expenses at the same time without the burden of having to worry about maintenance, insurance or risks of owning and operating the equipment.

The Differences in Prepaid PPAs Financing Options

For many end-users of solar electricity, a solar PPA agreement is the best option. However, due to the long-term nature of such an agreement, not many users can qualify as PPA customers in the eyes of the PPA providers and financiers on the other end.

The opportunity for a novel financing instrument is ripe in solar, as it’s a case of high demand and falsely perceived low supply of financing capital.

Prepaid PPAs are ideal for those who do not qualify for the long-term credit-worthiness of a PPA. It’s essentially a mix between a cash deal on the solar equipment and the ease and risk-averse benefits of a PPA. We call it the Prepaid PPA, which allows electricity end-users to pay upfront with a marked discount a percentage of the electricity produced throughout the operating facility. This reduces the credit risk and allows the project not only to start saving from day one, but gives the end-user a higher effective cash flow than a normal PPA due to the upfront payment discount.

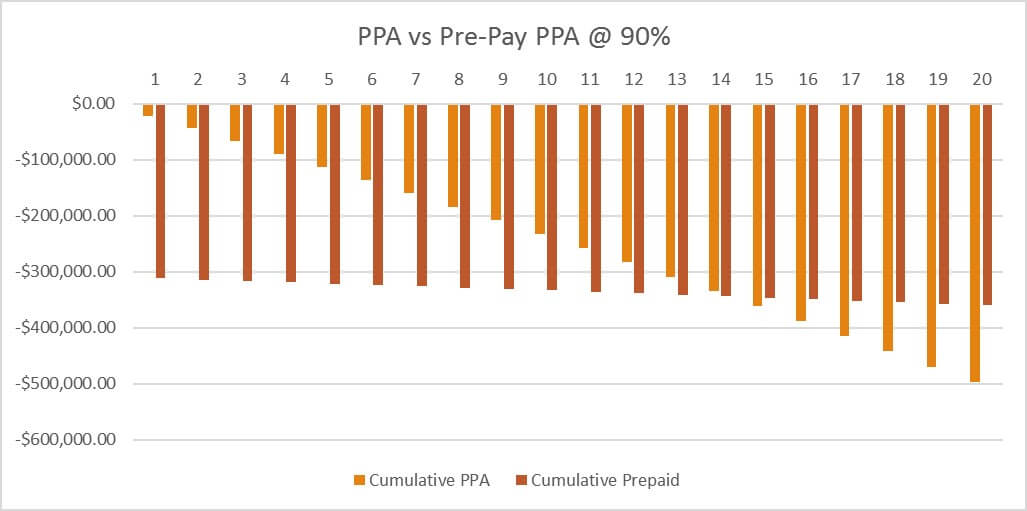

The PPA rate is given as 13 cents/kWh. Let’s say that the electricity price is 15 cents/kWh so switch to the power purchase agreement is a no brainer. However, when financiers assess the risk factors of this PPA, it will be often the case that a 100 kW system is on the small end of the spectrum for financing a PPA and soft costs would eat up most of the value and kill the project and its prospective for future energy savings. Also shown is the option of a 50% prepaid PPA represented in the adjacent darker orange bars as an attractive alternative that we can implement and make work for financiers. 50% of the projected power is paid up-front at an even steeper discount of 10 cents/kWh. For the life of the system, the rest of the power is sold at the same 13 cents/kWh creating an accumulated savings of $57,000.

This one example demonstrates a market creating opportunity for small-scale C&I (Commercial and Industrial) projects that have been on the back-burner due to negligence by financiers. A Prepaid PPA’s value can be best described through examples such as the above. Typical prepaid percentages are 25%, 50%, 75% and 90% but your developer should be able to offer you an endless range of customization for your prepay amount as you would receive on a home loan.

At the high end of the Prepaid Percentages, end-users can find a quicker path to ownership and learn-as-you-go when it comes to operating their own solar equipment alongside the O&M team. For example, we can use a 90% prepayment and provide an even steeper discount of 9 cents/kWh for the upfront. The rest of the payment will be billed at the PPA rate of 13 cents/kWh. This helps us cover insurance and O&M costs so you can enjoy the benefits of lower electricity bills care-free. At the end of 7 years, 10 or 15 years, we offer a buyout option for the system at Fair Market Value (Our legal team tells us to say that but we would donate it to you at year 7 when you a ready and comfortable to own the system yourself). Below is an example of a 90% Prepay. When it comes down to owning a PV power plant, we believe these can be in operation for well over 30 years if properly taken care of, so the electricity savings in the following chart might not be representative of overall savings.

This example saves you $137,000:

“Price is what you pay. Value is what you get.” – Warren Buffett

Power Purchase Agreements

- No Money Down Energy Savings

- Peace of Mind Maintenance

- Not everyone qualifies

Pre-Paid PPAs

- Most everyone qualifies

- Path to Ownership is faster and simpler

- Peace of Mind Maintenance

- Greater overall lifetime savings than a normal PPA